The year 2023 marked a significant recovery and upswing in the financial performance of leading hotel companies. The following analysis, largely published under Hospitality On (2024), offers a detailed overview of the financial results of Minor Hotels, Hilton, Marriott, Wyndham, IHG, Choice, Ascott, and Melia, with particular attention to revenue, profit, and RevPAR.

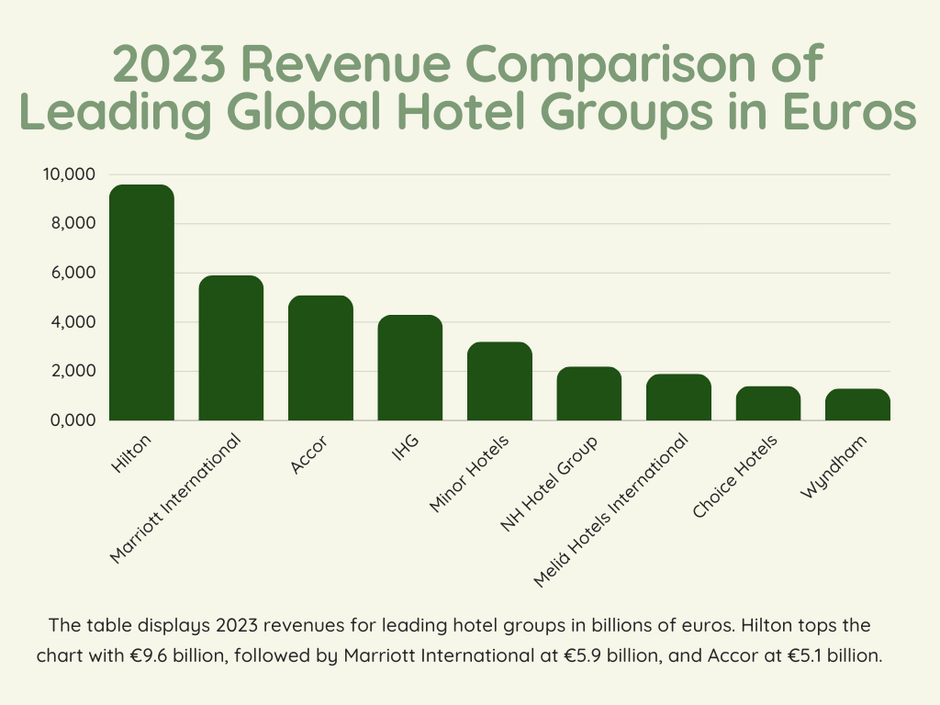

Minor Hotels (2024) achieved an outstanding core revenue of $3.4 billion (€3.2 billion) in 2023, representing a 25% increase over the previous year. The core net profit impressed with an increase of 450% compared to the previous year, highlighting the group's extraordinary recovery and expansion. The ADR across the entire group increased by 10%, while RevPAR increased by 22% to $300. This performance enhancement particularly reflects strong demand in key markets in Europe and Thailand.

NH Hotel Group, as part of Minor Hotels, achieved a revenue of €2.2 billion in 2023, which corresponds to an increase of 23% compared to 2022. The net profit grew to €128.1 million, representing an increase of 27.7%. RevPAR stood at €94, representing an impressive increase of 26% over 2022. These figures underscore the group's strengthened market position and operational efficiency.

As reported by Hotelinside (2024), the growth resulted from effective portfolio modernization and optimized cost control. Significant contributions were made by the increases in the average daily rate by 13% to €138 and occupancy rate by seven percentage points to 68%, which significantly increased RevPAR. Additionally, strong operational cash flow led to a reduced net financial debt and enabled substantial investments in new projects. Notable revenue increases in key markets such as Spain and Italy, as well as robust growth in volatile markets like Latin America, further contributed to the group's financial strength and market position.

Hilton (2024) reported for 2023 a revenue of $10.2 billion (€9.6 billion), a net profit of $1.1 billion, and an adjusted EBITDA of $3.1 billion. RevPAR increased by 12.6% to $142 system-wide. This development shows Hilton's ongoing ability to thrive in a competitive environment and successfully drive its extensive development program, with a pipeline that has grown by 11% to 462,400 rooms.

Marriott International (2024) achieved a revenue of $6.3 billion (€5.9 billion), a net profit of $3.1 billion, and an adjusted EBITDA of $4.7 billion in 2023. Marriott also reported a global RevPAR increase of 15% to $131. The company signed 164,000 rooms in 2023, and its development pipeline reached a new high of approximately 573,000 rooms. This expansion underscores Marriott's strategic focus on growth and diversification of its global presence, particularly in international markets.

Wyndham (2024) reported revenue of $1.4 billion, net income of $289 million (€271 million), with adjusted EBITDA at $659 million. RevPAR grew by 5% to $58 in constant currency. These figures reflect Wyndham’s effective adaptation to global market trends and its ability to achieve sustainable growth across various segments.

IHG (2024) showed strong financial performance with total revenues of $4.6 billion (€4.3 billion) and an operating income of $1.1 billion. RevPAR increased by 7% to $110. The significant increase in operating income of 70% over the previous year reflects successful expansion and improved operational efficiency. IHG announced share buybacks worth $800 million.

Accor (2024) achieved a revenue of €5.1 billion in 2023, representing an 18% increase over the previous year. Adjusted EBITDA reached a historic high of €1.0 billion, surpassing the billion-euro mark for the first time. Net profit amounted to €633 million. During the same period, Accor reported a 12% increase in RevPAR on a European level and an expansion of the network by 291 new hotels with 41,000 rooms, resulting in a 2.4% net growth. These increases demonstrate Accor's ongoing expansion and strengthening of its market presence, particularly in the luxury and lifestyle segments. The development pipeline included around 225,000 rooms at the end of the year, underscoring the group's dynamic growth strategy.

Choice Hotels (2024) achieved total revenues of $1.5 billion (€1.4 billion) and EBITDA of $540.5 million in 2023, an increase of 13%. RevPAR improved by 12.7% to $85 compared to 2019, underscoring the company's ability to grow despite challenging economic conditions.

Ascott (2024) reported a 28% increase in fee-based earnings to S$331 million and a RevPAR increase of 20% to S$120. These figures underscore Ascott's dynamic market penetration and focus on sustainable, profit-oriented growth. 77 new properties across all brands were signed in 2023.

Meliá Hotels International (2024) reported revenues of €1.9 billion and an adjusted EBITDA of €486.5 million. RevPAR increased by 17.3% to €102. The positive development of revenues and EBITDA reflects Meliá's successful adaptation to increasing tourist demand and the effective implementation of its strategic initiatives.

The financial results of these leading hotel companies in 2023 testify to robust recovery and strong growth, underscoring their ability to effectively adapt to constantly changing market conditions. These consolidated data provide a clear perspective on the performance and strategic priorities in the global hotel industry.

Sources:

Hospitality On. (2024) Record-breaking hotel performance in 2023. https://hospitality-on.com/en/finance/update-record-breaking-hotel-performance-2023#:~:text=The%20year%202023%20also%20marks,in%202022%2C%20at%20%241%2C086%20million

Minor Hotels. (2024) Record Revenue Drives 450% Profit Growth for Minor Hotels in Full-Year 2023 Earnings. https://media.minorhotels.com/234639-record-revenue-drives-450-profit-growth-for-minor-hotels-in-full-year-2023-earnings

Hotelinside. (2024) NH Hotel Group: Was steckt hinter den Rekordzahlen von 2023?. https://hotelinside.ch/nh-hotel-group-was-steckt-hinter-den-rekordzahlen-von-2023/

Hilton. (2024) Hilton Reports Fourth Quarter and Full Year Results. https://ir.hilton.com/~/media/Files/H/Hilton-Worldwide-IR-V3/quarterly-results/2024/q4-2023-earnings-release.pdf

Marriott International. (2024) Marriott International Reports Strong Fourth Quarter and Full Year 2023 Results.https://news.marriott.com/news/2024/02/13/marriott-international-reports-strong-fourth-quarter-and-full-year-2023-results sowie https://marriott.gcs-web.com/static-files/fab13bad-9342-4162-b392-d5a1cba1403f

Wyndham. (2024) Wyndham Hotels & Resorts Reports Strong Fourth Quarter Results with Record Openings, Retention and System Growth. https://investor.wyndhamhotels.com/news-events/press-releases/detail/309/wyndham-hotels-resorts-reports-strong-fourth-quarter#:~:text=Full%2Dyear%202023%20diluted%20EPS,million%20for%20the%20full%2Dyear.

IHG. (2024) Annual Report 2023. https://www.ihgplc.com/~/media/Files/I/Ihg-Plc/investors/annual-report/2023/annual-report-2023.pdf

Accor (2024) Full-Year 2023 Results: Record EBITDA of more than €1 billion. https://press.accor.com/full-year-2023-results-record-ebitda-of-more-than-eur1-billion/?lang=en

Choice Hotels. (2024) Choice Hotels International Reports Fourth Quarter And Full-Year 2023 Results. https://media.choicehotels.com/2024-02-20-Choice-Hotels-International-Reports-Fourth-Quarter-And-Full-Year-2023-Results

Ascott. (2024) Ascott Achieves Record Year of Fee Earnings at S$331M and Highest Number of Property Openings in FY 2023. https://www.capitaland.com/content/dam/capitaland-newsroom/International/2024/february/ascott-achieves-record-year-fee-earnings-sgd331m-highest-number-of-property-openings-in-fy2023/nr-Ascott-achieves-record-yr-of-fee-earnings-at-SGD331M-and-highest-number-ppty-openings-in-FY2023.pdf

Meliá Hotels International (2024) in journaldespalaces.com (2024) Meliá: Annual Results 2023.https://www.journaldespalaces.com/en/pressrelease-69610-Melia-Annual-results-2023.html#:~:text=ANNUAL%20RESULTS%202023-,Meliá%20earned%20€130%20million%20(%2B8.3%25%20vs.,its%20brands%20and%20digital%20strength.